Can An Employer Change The Health Insurance Carrier And The Level Of Benefits During The Year

Life insurance certificate issued by the Yorkshire Burn & Life Insurance Visitor to Samuel Holt, Liverpool, England, 1851. On display at the British Museum in London

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated casher a sum of money upon the death of an insured person (often the policy holder). Depending on the contract, other events such as final illness or critical illness can also trigger payment. The policy holder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses.

Life policies are legal contracts and the terms of each contract depict the limitations of the insured events. Oftentimes, specific exclusions written into the contract limit the liability of the insurer; mutual examples include claims relating to suicide, fraud, war, riot, and civil mayhem. Difficulties may ascend where an event is not clearly defined, for instance: the insured knowingly incurred a risk past consenting to an experimental medical procedure or past taking medication resulting in injury or death.

Mod life insurance bears some similarity to the nugget-direction industry,[i] [ failed verification ] and life insurers have diversified their product offerings into retirement products such as annuities.[two]

Life-based contracts tend to autumn into two major categories:

- Protection policies: designed to provide a benefit, typically a lump-sum payment, in the effect of a specified occurrence. A common grade—more than common in years past[ when? ]—of a protection-policy design is term insurance.

- Investment policies: the main objective of these policies is to facilitate the growth of capital by regular or single premiums. Common forms (in the The states) are whole life, universal life, and variable life policies.

History [edit]

An early on course of life insurance dates to Ancient Rome; "burial clubs"[3] covered the cost of members' funeral expenses and assisted survivors financially. In 1816, an archeological earthworks in Minya, Egypt (under an Eyalet of the Ottoman Empire) produced a Nerva–Antonine dynasty-era tablet from the ruins of the Temple of Antinous in Antinoöpolis, Aegyptus that prescribed the rules and membership dues of a burial social club collegium established in Lanuvium, Italia in approximately 133 Advertizing during the reign of Hadrian (117–138) of the Roman Empire.[4] In 1851, futurity U.S. Supreme Court Associate Justice Joseph P. Bradley (1870–1892), once employed as an actuary for the Mutual Benefit Life Insurance Company, submitted an article to the Journal of the Found of Actuaries detailing an historical business relationship of a Severan dynasty-era life table compiled by the Roman jurist Ulpian in approximately 220 Advertizement during the reign of Elagabalus (218–222) that was included in the Digesta seu Pandectae (533) codification ordered by Justinian I (527–565) of the Eastern Roman Empire.[5]

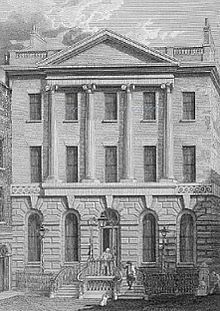

The earliest known life insurance policy was made in Royal Substitution, London on 18 June 1583. A Richard Martin insured a William Gybbons, paying thirteen merchants xxx pounds for 400 if the insured dies within one year.[six] [seven] The first company to offering life insurance in modern times was the Amicable Order for a Perpetual Assurance Office, founded in London in 1706 past William Talbot and Sir Thomas Allen.[8] [ix] Each member made an annual payment per share on i to three shares with consideration to historic period of the members existence twelve to fifty-v. At the finish of the year a portion of the "amicable contribution" was divided among the wives and children of deceased members, in proportion to the number of shares the heirs owned. The Amicable Lodge started with 2000 members.[10] [11]

The commencement life tabular array was written by Edmund Halley in 1693, but it was only in the 1750s that the necessary mathematical and statistical tools were in identify for the evolution of modern life insurance. James Dodson, a mathematician and actuary, tried to establish a new visitor aimed at correctly offsetting the risks of long term life assurance policies, afterward beingness refused access to the Amicable Life Balls Society because of his advanced age. He was unsuccessful in his attempts at procuring a lease from the government.

His disciple, Edward Rowe Mores, was able to constitute the Club for Equitable Assurances on Lives and Survivorship in 1762. Information technology was the world's first mutual insurer and it pioneered age based premiums based on bloodshed rate laying "the framework for scientific insurance practice and development"[12] and "the basis of modernistic life assurance upon which all life assurance schemes were afterward based".[13]

Mores also gave the proper name actuary to the chief official—the earliest known reference to the position as a business concern. The commencement modern actuary was William Morgan, who served from 1775 to 1830. In 1776 the Society carried out the outset actuarial valuation of liabilities and subsequently distributed the start reversionary bonus (1781) and acting bonus (1809) among its members.[12] It besides used regular valuations to balance competing interests.[12] The Society sought to treat its members deservedly and the Directors tried to ensure that policyholders received a fair return on their investments. Premiums were regulated according to age, and anybody could be admitted regardless of their state of health and other circumstances.[xiv]

Life insurance premiums written in 2005

The sale of life insurance in the U.S. began in the 1760s. The Presbyterian Synods in Philadelphia and New York City created the Corporation for Relief of Poor and Distressed Widows and Children of Presbyterian Ministers in 1759; Episcopalian priests organized a similar fund in 1769. Between 1787 and 1837 more than ii dozen life insurance companies were started, but fewer than half a dozen survived. In the 1870s, military machine officers banded together to found both the Ground forces (AAFMAA) and the Navy Common Aid Association (Navy Mutual), inspired past the plight of widows and orphans left stranded in the West after the Battle of the Niggling Big Horn, and of the families of U.Due south. sailors who died at ocean.

Overview [edit]

Parties to contract [edit]

The person responsible for making payments for a policy is the policy owner, while the insured is the person whose expiry volition trigger payment of the death benefit. The owner and insured may or may not be the same person. For case, if Joe buys a policy on his own life, he is both the possessor and the insured. But if Jane, his wife, buys a policy on Joe's life, she is the owner and he is the insured. The policy owner is the guarantor and they will be the person to pay for the policy. The insured is a participant in the contract, but not necessarily a party to it.

Chart of a life insurance

The beneficiary receives policy proceeds upon the insured person's death. The owner designates the beneficiary, but the beneficiary is not a party to the policy. The owner can change the beneficiary unless the policy has an irrevocable beneficiary designation. If a policy has an irrevocable casher, any beneficiary changes, policy assignments, or cash value borrowing would require the agreement of the original casher.

In cases where the policy possessor is non the insured (as well referred to every bit the celui qui vit or CQV), insurance companies have sought to limit policy purchases to those with an insurable interest in the CQV. For life insurance policies, shut family members and business partners will usually exist establish to have an insurable interest. The insurable interest requirement usually demonstrates that the purchaser will actually endure some kind of loss if the CQV dies. Such a requirement prevents people from benefiting from the buy of purely speculative policies on people they expect to die. With no insurable involvement requirement, the adventure that a purchaser would murder the CQV for insurance proceeds would be great. In at to the lowest degree 1 instance, an insurance company which sold a policy to a purchaser with no insurable interest (who later murdered the CQV for the gain), was found liable in court for contributing to the wrongful death of the victim (Liberty National Life v. Weldon, 267 Ala.171 (1957)).

Contract terms [edit]

Special exclusions may apply, such as suicide clauses, whereby the policy becomes zippo and void if the insured dies by suicide within a specified time (usually two years subsequently the buy date; some states provide a statutory one-year suicide clause). Any misrepresentations by the insured on the application may also be grounds for nullification. Most US states, for case, specify a maximum contestability period, ofttimes no more ii years. But if the insured dies inside this period will the insurer accept a legal right to contest the claim on the ground of misrepresentation and request additional data before deciding whether to pay or deny the merits.

The face up amount of the policy is the initial amount that the policy volition pay at the decease of the insured or when the policy matures, although the actual death do good can provide for greater or lesser than the confront amount. The policy matures when the insured dies or reaches a specified age (such equally 100 years old).

Costs, insurability, and underwriting [edit]

The insurance company calculates the policy prices (premiums) at a level sufficient to fund claims, encompass administrative costs, and provide a profit. The cost of insurance is determined using mortality tables calculated by actuaries. Bloodshed tables are statistically based tables showing expected annual mortality rates of people at different ages. As people are more likely to die every bit they get older, the mortality tables enable the insurance companies to summate the risk and increase premiums with historic period accordingly. Such estimates can be important in taxation regulation.[xv] [16]

In the 1980s and 1990s, the SOA 1975-80 Basic Select & Ultimate tables were the typical reference points, while the 2001 VBT and 2001 CSO tables were published more than recently. As well as the bones parameters of age and gender, the newer tables include split mortality tables for smokers and non-smokers, and the CSO tables include separate tables for preferred classes.[17]

The mortality tables provide a baseline for the cost of insurance, but the health and family unit history of the private applicant is as well taken into business relationship (except in the case of Grouping policies). This investigation and resulting evaluation is termed underwriting. Health and lifestyle questions are asked, with certain responses peradventure meriting farther investigation.

Specific factors that may exist considered by underwriters include:

- Personal medical history;[18]

- Family medical history;[nineteen]

- Driving record;[twenty]

- Height and weight matrix, otherwise known as BMI (Body Mass Index).[21]

Based on the above and additional factors, applicants will be placed into ane of several classes of health ratings which will determine the premium paid in commutation for insurance at that detail carrier.[20]

Life insurance companies in the United States back up the Medical Data Bureau (MIB),[22] which is a clearing business firm of information on persons who have applied for life insurance with participating companies in the last vii years. As part of the application, the insurer often requires the applicant's permission to obtain information from their physicians.[23]

Automatic Life Underwriting is a technology solution which is designed to perform all or some of the screening functions traditionally completed by underwriters, and thus seeks to reduce the work attempt, fourth dimension and/or information necessary to underwrite a life insurance application.[24] These systems allow point of sale distribution and tin can shorten the time frame for issuance from weeks or fifty-fifty months to hours or minutes, depending on the amount of insurance beingness purchased.[25]

The mortality of underwritten persons rises much more quickly than the general population. At the end of 10 years, the bloodshed of that 25-yr-one-time, not-smoking male is 0.66/g/year. Consequently, in a group of i thousand 25-year-old males with a $100,000 policy, all of average wellness, a life insurance company would have to collect approximately $l a twelvemonth from each participant to encompass the relatively few expected claims. (0.35 to 0.66 expected deaths in each year × $100,000 payout per death = $35 per policy.) Other costs, such as authoritative and sales expenses, also need to be considered when setting the premiums. A 10-year policy for a 25-year-former non-smoking male with preferred medical history may go offers as low as $90 per year for a $100,000 policy in the competitive US life insurance marketplace.

Most of the revenue received past insurance companies consists of premiums, but revenue from investing the premiums forms an important source of profit for most life insurance companies. Group insurance policies are an exception to this.

In the United States, life insurance companies are never legally required to provide coverage to anybody, with the exception of Civil Rights Act compliance requirements. Insurance companies alone make up one's mind insurability, and some people are deemed uninsurable. The policy can be declined or rated (increasing the premium corporeality to recoup for the college hazard), and the corporeality of the premium will exist proportional to the face value of the policy.

Many companies dissever applicants into iv general categories. These categories are preferred all-time, preferred, standard, and tobacco. Preferred best is reserved merely for the healthiest individuals in the general population. This may mean, that the proposed insured has no adverse medical history, is not under medication, and has no family history of early-onset cancer, diabetes, or other weather condition. Preferred means that the proposed insured is currently nether medication and has a family history of particular illnesses. Almost people are in the standard category.

People in the tobacco category typically have to pay higher premiums due to the higher bloodshed. Contempo[ when? ] US bloodshed tables predict that roughly 0.35 in one,000 non-smoking males anile 25 will die during the first year of a policy.[26] Bloodshed approximately doubles for every boosted ten years of age, and so the bloodshed rate in the beginning yr for non-smoking men is nearly 2.5 in 1,000 people at age 65.[26] Compare this with the U.s.a. population male mortality rates of 1.3 per one,000 at age 25 and nineteen.three at age 65 (without regard to wellness or smoking status).[27]

Death benefits [edit]

Upon the insured'south death, the insurer requires acceptable proof of death earlier information technology pays the merits. If the insured'southward expiry is suspicious and the policy amount is large, the insurer may investigate the circumstances surrounding the expiry before deciding whether information technology has an obligation to pay the claim.

Payment from the policy may be as a lump sum or as an annuity, which is paid in regular installments for either a specified menstruation or for the beneficiary's lifetime.[28]

Insurance vs balls [edit]

The specific uses of the terms "insurance" and "assurance" are sometimes confused. In full general, in jurisdictions where both terms are used, "insurance" refers to providing coverage for an event that might happen (fire, theft, flood, etc.), while "assurance" is the provision of coverage for an result that is certain to happen. In the U.s.a., both forms of coverage are called "insurance" for reasons of simplicity in companies selling both products.[ citation needed ] By some definitions, "insurance" is any coverage that determines benefits based on bodily losses whereas "assurance" is coverage with predetermined benefits irrespective of the losses incurred.

Life insurance may be divided into two basic classes: temporary and permanent; or the following subclasses: term, universal, whole life, and endowment life insurance.

Term insurance [edit]

Term balls provides life insurance coverage for a specified term. The policy does not accumulate cash value. Term insurance is significantly less expensive than an equivalent permanent policy but volition become higher with age. Policy holders tin can salve to provide for increased term premiums or decrease insurance needs (past paying off debts or saving to provide for survivor needs).[29]

Mortgage life insurance insures a loan secured past real belongings and usually features a level premium amount for a declining policy face value because what is insured is the principal and interest outstanding on a mortgage that is constantly being reduced by mortgage payments. The face amount of the policy is always the amount of the main and interest outstanding that are paid should the applicant dice before the terminal installment is paid.

Grouping life insurance [edit]

Group life insurance (too known as wholesale life insurance or institutional life insurance) is term insurance covering a group of people, usually employees of a visitor, members of a matrimony or clan, or members of a pension or superannuation fund. Individual proof of insurability is not normally a consideration in its underwriting. Rather, the underwriter considers the size, turnover, and financial strength of the grouping. Contract provisions will endeavor to exclude the possibility of adverse option. Group life insurance often allows members exiting the grouping to maintain their coverage by buying individual coverage. The underwriting is carried out for the whole grouping instead of individuals.

Permanent life insurance [edit]

Permanent life insurance is life insurance that covers the remaining lifetime of the insured. A permanent insurance policy accumulates a cash value up to its date of maturation. The owner can access the coin in the greenbacks value by withdrawing money, borrowing the cash value, or surrendering the policy and receiving the give up value.

The three bones types of permanent insurance are whole life, universal life, and endowment.

Whole life [edit]

Whole life insurance provides lifetime coverage for a fix premium corporeality.

Universal life coverage [edit]

Universal life insurance (ULl) is a relatively new insurance production, intended to combine permanent insurance coverage with greater flexibility in premium payments, forth with the potential for greater growth of cash values. There are several types of universal life insurance policies, including interest-sensitive (also known equally "traditional fixed universal life insurance"), variable universal life (VUL), guaranteed death benefit, and has equity-indexed universal life insurance.

Universal life insurance policies have greenbacks values. Paid-in premiums increase their cash values; administrative and other costs reduce their cash values.

Universal life insurance addresses the perceived disadvantages of whole life—namely that premiums and decease benefits are fixed. With universal life, both the premiums and decease benefit are flexible. With the exception of guaranteed-death-benefit universal life policies, universal life policies trade their greater flexibility off for fewer guarantees.

"Flexible death benefit" means the policy owner tin can cull to decrease the death benefit. The death benefit can also exist increased by the policy owner, usually requiring new underwriting. Some other feature of flexible death benefit is the ability to choose option A or choice B death benefits and to change those options over the course of the life of the insured. Option A is frequently referred to equally a "level expiry benefit"; death benefits remain level for the life of the insured, and premiums are lower than policies with Option B death benefits, which pay the policy's cash value—i.due east., a face amount plus earnings/interest. If the cash value grows over time, the death benefits do as well. If the cash value declines, the death benefit also declines. Option B policies usually feature higher premiums than option A policies.

Endowments [edit]

The endowment policy is a life insurance contract designed to pay a lump sum after a specific term (on its 'maturity') or on expiry. Typical maturities are ten, fifteen or twenty years upward to a certain historic period limit. Some policies also pay out in the case of disquisitional disease.

Policies are typically traditional with-profits or unit-linked (including those with unitized with-profits funds).

Endowments tin exist cashed in early (or surrendered) and the holder so receives the surrender value which is determined by the insurance company depending on how long the policy has been running and how much has been paid into it.

Accidental death [edit]

Accidental death insurance is a blazon of limited life insurance that is designed to encompass the insured should they dice as the result of an blow. "Accidents" run the gamut from abrasions to catastrophes just normally do not include deaths resulting from non-blow-related health problems or suicide. Because they only comprehend accidents, these policies are much less expensive than other life insurance policies.

Such insurance can too be accidental death and dismemberment insurance or AD&D. In an AD&D policy, benefits are bachelor not merely for accidental expiry just likewise for the loss of limbs or body functions such as sight and hearing.

Accidental death and Advert&D policies pay actual benefits only very rarely, either because the cause of decease is non covered by the policy or because death occurs well after the accident, by which time the premiums take gone unpaid.[ clarification needed ] Various Advert&D policies have dissimilar terms and exclusions. Risky activities such as parachuting, flight, professional person sports, or military service are ofttimes omitted from coverage.

Adventitious decease insurance can also supplement standard life insurance as a rider. If a rider is purchased, the policy generally pays double the face up amount if the insured dies from an accident. This was once called double indemnity insurance. In some cases, triple indemnity coverage may be available.

Senior and pre-need products [edit]

Insurance companies have in contempo years developed products for niche markets, most notably targeting seniors in an ageing population. These are oft low to moderate face value whole life insurance policies, allowing senior citizens to purchase affordable insurance later in life. This may also be marketed equally concluding expense insurance and usually have death benefits between $2,000 and $twoscore,000.[ citation needed ] Ane reason for their popularity is that they only require answers to elementary "yes" or "no" questions, while most policies crave a medical exam to authorize. As with other policy types, the range of premiums can vary widely.

Health questions can vary substantially between exam and no-test policies. Information technology may be possible for individuals with certain conditions to qualify for one type of coverage and not some other.[ citation needed ] Because seniors sometimes are not fully enlightened of the policy provisions, policyholders may believe that their policies last for a lifetime, for example. and that Premiums on some policies increase at regular intervals, such every five years.[ citation needed ]

Pre-demand life insurance policies are limited premium payment, whole life policies that are usually purchased by older applicants, though they are available to everyone. This type of insurance is designed to cover specific funeral expenses that the bidder has designated in a contract with a funeral habitation. The policy's death do good is initially based on the funeral cost at the fourth dimension of prearrangement, and it then typically grows as involvement is credited. In commutation for the policy owner'southward designation, the funeral home typically guarantees that the gain will cover the cost of the funeral, no matter when death occurs. Backlog proceeds may go either to the insured'south manor, a designated beneficiary, or the funeral dwelling house every bit set forth in the contract. Purchasers of these policies normally brand a single premium payment at the fourth dimension of prearrangement, just some companies also allow premiums to be paid over equally much equally ten years.

[edit]

Riders are modifications to the insurance policy added at the same time the policy is issued. These riders change the basic policy to provide some feature desired past the policy owner. A common rider is adventitious expiry. Another mutual rider is a premium waiver, which waives time to come premiums if the insured becomes disabled.

Joint life insurance is either term or permanent life insurance that insures ii or more persons, with proceeds payable on the expiry of either.

Unit of measurement-linked insurance plans [edit]

Unit of measurement-linked insurance plans are unique insurance plans which are like to mutual funds and term insurance plans combined as i product. The investor does not participate in the profits of the plan per se, only gets returns based on the returns on the funds he or she had chosen.

With-profits policies [edit]

Some policies beget the policyholder a share of the profits of the insurance company—these are termed with-profits policies. Other policies provide no rights to a share of the profits of the company—these are non-profit policies.

With-profits policies are used as a class of collective investment scheme to accomplish capital growth. Other policies offer a guaranteed return not dependent on the company's underlying investment performance; these are often referred to as without-turn a profit policies, which may be construed equally a misnomer.[ by whom? ]

Taxation [edit]

India [edit]

According to the department 80C of the Income Taxation Act, 1961 (of Indian penal lawmaking) premiums paid towards a valid life insurance policy tin be exempted from the taxable income. Along with life insurance premium, section 80C allows exemption for other financial instruments such every bit Employee Provident Fund (EPF), Public Provident Fund (PPF), Equity Linked Savings Scheme (ELSS), National Savings Certificate (NSC), health insurance premium are some of them. The total amount that can exist exempted from the taxable income for section 80C is capped at a maximum of INR 150,000.[xxx] The exemptions are eligible for individuals (Indian citizens) or Hindu Undivided Family (HUF).

Apart from tax do good nether section 80C, in India, a policy holder is entitled for a tax exemption on the expiry do good received.[31] The received amount is fully exempt from Income Revenue enhancement under Section ten(10D).

Australia [edit]

Where the life insurance is provided through a superannuation fund, contributions fabricated to fund insurance premiums are tax deductible for self-employed persons and substantially self-employed persons and employers. Nevertheless where life insurance is held exterior of the superannuation environment, the premiums are generally not tax deductible. For insurance through a superannuation fund, the annual deductible contributions to the superannuation funds are subject to historic period limits. These limits apply to employers making deductible contributions. They also employ to self-employed persons and essentially self-employed persons. Included in these overall limits are insurance premiums. This means that no boosted deductible contributions can exist made for the funding of insurance premiums. Insurance premiums tin, nevertheless, be funded by undeducted contributions. For farther data on deductible contributions see "under what conditions can an employer claim a deduction for contributions made on behalf of their employees?" and "what is the definition of substantially cocky-employed?". The insurance premium paid by the superannuation fund can exist claimed by the fund as a deduction to reduce the 15% tax on contributions and earnings. (Ref: ITAA 1936, Department 279).[32]

South Africa [edit]

Premiums paid past a policyholder are not deductible from taxable income, although premiums paid via an canonical pension fund registered in terms of the Income Tax Act are permitted to be deducted from personal income tax (whether these premiums are nominally being paid by the employer or employee). The benefits arising from life assurance policies are generally non taxable as income to beneficiaries (over again in the case of approved benefits, these fall under retirement or withdrawal taxation rules from SARS). Investment return within the policy will be taxed inside the life policy and paid by the life assurer depending on the nature of the policyholder (whether natural person, visitor-endemic, untaxed or a retirement fund).

United States [edit]

Premiums paid by the policy owner are usually non deductible for federal and country income tax purposes, and gain paid by the insurer upon the decease of the insured are not included in gross income for federal and country income tax purposes.[33] However, if the proceeds are included in the "estate" of the deceased, it is probable they will be subject area to federal and country manor and inheritance tax.[ commendation needed ]

Cash value increases within the policy are non subject area to income taxes unless sure events occur. For this reason, insurance policies can be a legal and legitimate revenue enhancement shelter wherein savings tin increment without revenue enhancement until the possessor withdraws the coin from the policy. In flexible-premium policies, large deposits of premium could cause the contract to be considered a modified endowment contract by the Internal Revenue Service (IRS), which negates many of the tax advantages associated with life insurance. The insurance company, in virtually cases, will inform the policy owner of this danger earlier deciding their premium.

The tax ramifications of life insurance are circuitous. The policy owner would be well advised to advisedly consider them. As always, both the United states of america Congress and land legislatures can change the taxation laws at whatsoever fourth dimension.

In 2018, a fiduciary standard dominion on retirement products past the U.s. Department of Labor posed a possible risk.[34]

United kingdom of great britain and northern ireland [edit]

Premiums are non usually deductible against income taxation or corporation tax, withal qualifying policies issued prior to fourteen March 1984 do still attract LAPR (Life Balls Premium Relief) at xv% (with the internet premium being nerveless from the policyholder).

Non-investment life policies do non unremarkably concenter either income taxation or capital gains tax on a claim. If the policy has as investment element such as an endowment policy, whole of life policy or an investment bail then the tax handling is determined by the qualifying status of the policy.

Qualifying status is determined at the outset of the policy if the contract meets certain criteria. Essentially, long term contracts (x+ years) tend to be qualifying policies and the proceeds are gratuitous from income tax and capital gains taxation. Unmarried premium contracts and those running for a short term are discipline to income taxation depending upon the marginal rate in the year a gain is made. All UK insurers pay a special rate of corporation revenue enhancement on the profits from their life book; this is deemed as meeting the lower rate (20% in 2005-06) of liability for policyholders. Therefore, a policyholder who is a higher-rate taxpayer (40% in 2005-06), or becomes one through the transaction, must pay tax on the gain at the difference between the higher and the lower rate. This gain is reduced by applying a adding called top-slicing based on the number of years the policy has been held. Although this is complicated, the taxation of life assurance-based investment contracts may be beneficial compared to alternative equity-based collective investment schemes (unit trusts, investment trusts and OEICs). One feature which especially favors investment bonds is the "5% cumulative allowance"—the ability to draw 5% of the original investment amount each policy year without being discipline to any taxation on the amount withdrawn. If not used in i year, the 5% allowance can coil over into future years, subject to a maximum tax-deferred withdrawal of 100% of the premiums payable. The withdrawal is accounted past the HMRC (Her Majesty's Acquirement and Community) to be a payment of capital and therefore, the taxation liability is deferred until maturity or surrender of the policy. This is an specially useful tax planning tool for higher rate taxpayers who expect to become basic rate taxpayers at some predictable indicate in the futurity, as at this signal the deferred tax liability volition not result in tax existence due.

The proceeds of a life policy will exist included in the estate for death duty (in the Britain, inheritance taxation) purposes. Policies written in trust may fall exterior the estate. Trust police and tax of trusts can be complicated, so any individual intending to use trusts for tax planning would unremarkably seek professional advice from an independent financial adviser and/or a solicitor.

Alimony term balls [edit]

Although bachelor before April 2006, from this date pension term balls became widely available in the United kingdom of great britain and northern ireland. Almost UK insurers adopted the name "life insurance with tax relief" for the product. Pension term balls is effectively normal term life assurance with tax relief on the premiums. All premiums are paid at a net of bones rate tax at 22%, and higher-rate tax payers can gain an extra 18% tax relief via their tax return. Although not suitable for all, PTA briefly became 1 of the most mutual forms of life assurance sold in the UK until, Chancellor Gordon Brown announced the withdrawal of the scheme in his pre-upkeep announcement on 6 Dec 2006.

Stranger originated [edit]

Stranger-originated life insurance or STOLI is a life insurance policy that is held or financed by a person who has no relationship to the insured person. Mostly, the purpose of life insurance is to provide peace of mind past assuring that financial loss or hardship will be alleviated in the event of the insured person's death. STOLI has often been used as an investment technique whereby investors will encourage someone (usually an elderly person) to purchase life insurance and name the investors every bit the beneficiary of the policy. This undermines the primary purpose of life insurance, as the investors would incur no financial loss should the insured person dice. In some jurisdictions, there are laws to discourage or prevent STOLI.

Criticism [edit]

Although some aspects of the application process (such every bit underwriting and insurable interest provisions) make it difficult, life insurance policies have been used to facilitate exploitation and fraud. In the case of life insurance, at that place is a possible motive to purchase a life insurance policy, specially if the face value is substantial, then murder the insured. Usually, the larger the merits and/or the more than serious the incident, the larger and more intense the ensuing investigation by police and insurer investigators.[35] The television set series Forensic Files has included episodes that feature this scenario. There was likewise a documented case in Los Angeles in 2006 where two elderly women were accused of taking in homeless men and assisting them. As function of their assistance, they took out life insurance for the men. After the contestability period ended on the policies, the women are alleged to have had the men killed via hitting-and-run vehicular homicide.[36]

Recently, viatical settlements have created bug for life insurance providers. A viatical settlement involves the purchase of a life insurance policy from an elderly or terminally ill policy holder. The policy holder sells the policy (including the correct to name the casher) to a purchaser for a cost discounted from the policy value. The seller has cash in hand, and the purchaser will realize a turn a profit when the seller dies and the proceeds are delivered to the purchaser. In the meantime, the purchaser continues to pay the premiums. Although both parties have reached an agreeable settlement, insurers are troubled by this trend. Insurers summate their rates with the supposition that a sure portion of policy holders will seek to redeem the cash value of their insurance policies before death. They as well expect that a certain portion volition stop paying premiums and forfeit their policies. However, viatical settlements ensure that such policies will with absolute certainty be paid out. Some purchasers, in order to take reward of the potentially large profits, have even actively sought to collude with uninsured elderly and terminally sick patients, and created policies that would accept non otherwise been purchased. These policies are guaranteed losses from the insurers' perspective.[ citation needed ]

On April 17, 2016, a report by Lesley Stahl on lx Minutes claimed that life insurance companies practice not pay meaning numbers of beneficiaries.[37] This is because many people named every bit beneficiaries never submit claims to the insurance companies upon the death of the insured, and are unaware that any benefit exists to exist claimed, though the insurance companies have total noesis. The amounts of such benefits are often small, but the numbers of would-be beneficiaries are quite large. These unclaimed benefits somewhen become sources of profit.

See too [edit]

- Corporate-endemic life insurance

- Critical illness insurance

- Economic capital letter

- Manor planning

- Simulated insurance claims

- General insurance

- Internal Revenue Code section 79

- Interstate Insurance Product Regulation Committee

- Life expectancy

- Life settlement

- Pet insurance

- Retirement planning

- Return of premium life insurance

- Segregated funds

- Servicemembers' Group Life Insurance

- Term life insurance

- Tontine

References [edit]

Specific references [edit]

- ^ "The Manufacture Handbook: The Insurance Industry". Investopedia. 2004-01-07. Archived from the original on 2018-09-07. Retrieved 2018-eleven-28 .

- ^ "Industry Overview: Life Insurance". world wide web.valueline.com. ValueLine. Retrieved 2018-11-28 .

- ^ "Burying Practices in Ancient Rome". The Great Courses Daily. 2020-05-31. Retrieved 2021-03-11 .

- ^ The Documentary History of Insurance, g B.C.–1875 A.D. Newark, NJ: Prudential Printing. 1915. pp. five–6. Retrieved June 15, 2021.

- ^ The Documentary History of Insurance, 1000 B.C.–1875 A.D. Newark, NJ: Prudential Press. 1915. pp. 6–7. Retrieved June 15, 2021.

- ^ Fouse, Fifty. K. (September 1905). "Policy Contracts in Life Insurance". The Annals of the American University of Political and Social Science. 26 (2): 29–48. doi:10.1177/000271620502600203. JSTOR 1011003. S2CID 143550312. Retrieved 8 April 2021.

- ^ Walford, Cornelius (22 Dec 1884). History of Life Assurance (PDF). p. six-7. Retrieved 8 April 2021.

- ^ Anzovin, Steven, Famous First Facts 2000, detail # 2422, H. W. Wilson Company, ISBN 0-8242-0958-3 p. 121 The start life insurance visitor known of tape was founded in 1706 past the Bishop of Oxford and the financier Thomas Allen in London, England. The company, chosen the Amicable Society for a Perpetual Assurance Office, collected almanac premiums from policyholders and paid the nominees of deceased members from a common fund.

- ^ Amicable Society, The charters, acts of Parliament, and by-laws of the corporation of the Amicable Club for a perpetual assurance function, Gilbert and Rivington, 1854, p. iv

- ^ Amicable Society, The charters, acts of Parliament, and by-laws of the corporation of the Amicable Society for a perpetual assurance office, Gilbert and Rivington, 1854 Amicable Lodge, article V p. 5

- ^ Price, pp 158-171

- ^ a b c "Importance of the Equitable Life Archive". The Actuarian Profession. 2009-06-25. Archived from the original on 2015-09-11. Retrieved 2014-02-twenty .

- ^ "Today and History:The History of Equitable Life". 2009-06-26. Archived from the original on 2009-06-29. Retrieved 2009-08-sixteen .

- ^ Lord Penrose (2004-03-08). "Chapter 1 The Equitable Life Inquiry" (PDF). HM Treasury. Archived from the original (PDF) on 2008-09-ten. Retrieved 2009-08-20 .

- ^ "IRS Retirement Plans FAQs regarding Acquirement Ruling 2002-62". irs.gov. Archived from the original on 8 Baronial 2012. Retrieved 14 April 2018.

- ^ "IRS Bulletin No. 2002–42" (PDF). irs.gov. Archived (PDF) from the original on two May 2017. Retrieved fourteen April 2018.

- ^ "AAA/SOA Review of the Acting Mortality Tables Developed past Tillinghast and Proposed for Use by the ACLI from the Joint American Academy of Actuaries/Club of Actuaries Review Team" Archived 2007-07-03 at the Wayback Machine August 29, 2006

- ^ Rothstein, 2004, p. 38.

- ^ Rothstein, 2004, p. 92.

- ^ a b Rothstein, 2004, p. 65.

- ^ Kutty, 2008, p. 532.

- ^ Medical Information Bureau (MIB) Archived 2016-08-17 at the Wayback Motorcar website

- ^ MIB Consumer FAQs Archived 2007-04-xv at the Wayback Auto

- ^ "Archived copy" (PDF). Archived (PDF) from the original on 2016-06-16. Retrieved 2016-05-24 .

{{cite web}}: CS1 maint: archived copy every bit title (link) - ^ "Archived copy" (PDF). Archived (PDF) from the original on 2015-09-15. Retrieved 2016-05-24 .

{{cite web}}: CS1 maint: archived copy as title (link) - ^ a b Actuary.org Archived 2007-09-28 at the Wayback Automobile

- ^ Arias, Elizabeth (2004-02-18). "U.s. Life Tables, 2001" (PDF). National Vital Statistics Reports. 52 (14): 1–38. PMID 15008552. Archived (PDF) from the original on 17 October 2011. Retrieved iii November 2011.

- ^ OECD (five December 2016). Life Annuity Products and Their Guarantees. OECD Publishing. pp. ten–13. ISBN978-92-64-26531-8.

- ^ Black, Kenneth, Jr.; Skipper, Harold D., Jr. (1994). Life Insurance (quaternary ed.). p. 94. ISBN0135329957.

- ^ "Section - 80C, Income-taxation Human action, 1961-2018:B.—Deductions in respect of certain payments". Income Revenue enhancement Republic of india . Retrieved 6 November 2018.

- ^ "Income Tax Section". world wide web.incometaxindia.gov.in . Retrieved 2020-05-21 .

- ^ "ITAA 1936, Section 279". Archived from the original on 2011-08-28.

- ^ Internal Revenue Lawmaking § 101(a)(ane)

- ^ "2018 Insurance Industry Outlook | Deloitte US". Deloitte Usa . Retrieved 2018-11-28 .

- ^ tchinnosian, dennis jay, jim quiggle, howard goldblatt, kendra smith, jennifer. "Fraud: why should y'all worry?". www.insurancefraud.org. Archived from the original on 13 November 2012. Retrieved xiv April 2018.

- ^ "Two Elderly Women Indicted on Fraud Charges in Deaths of LA Hit-Run". Insurance Journal. June ane, 2006. Archived from the original on November 4, 2006.

- ^ "Life insurance industry under investigation". cbsnews.com. Archived from the original on 8 December 2017. Retrieved 14 April 2018.

General sources [edit]

- Kutty, Shashidharan (12 August 2008). Managing Life Insurance. PHI Learning Pvt. Ltd. ISBN978-81-203-3531-viii.

- Oviatt, F. C. "Economic place of insurance and its relation to guild" in American Academy of Political and Social Science; National American Woman Suffrage Association Drove (Library of Congress) (1905). Register of the American Academy of Political and Social Science. Vol. XXVI. Published past A. Fifty. Hummel for the American University of Political and Social Scientific discipline. pp. 181–191. Retrieved 8 June 2011.

- Rothstein, Marker A. (2004). Genetics and Life Insurance: Medical Underwriting and Social Policy. MIT Press. ISBN978-0-262-18236-2.

External links [edit]

Source: https://en.wikipedia.org/wiki/Life_insurance

Posted by: maasthip1940.blogspot.com

0 Response to "Can An Employer Change The Health Insurance Carrier And The Level Of Benefits During The Year"

Post a Comment